Olivier Van Haute, Portfolio Manager for DPAM Global Balanced Funds, is confident in financial markets’ ability to continue yielding positive returns for the active and discerning investor.

As always, DPAM believes that an active research-driven strategy that is mindful of financial and non-financial factors, including environmental, social and governance risks, is the best approach to bring the ship – and precious returns cargo – safely back to harbor. To summarize DPAM’s recommendation to asset allocators at this intermediate stage of the cycle: Be ready to re-engage with conviction and selectivity! In this article, we explain DPAM’s view for your consideration.

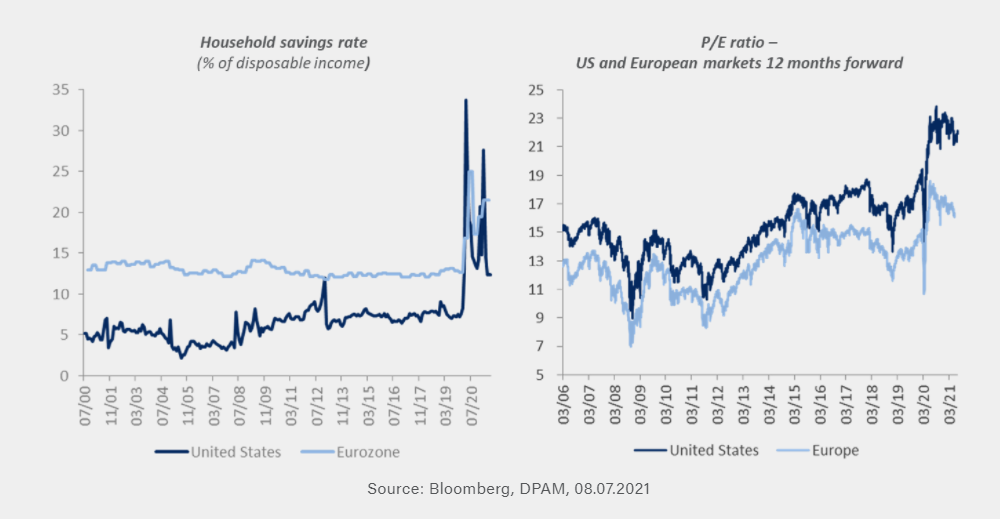

Positive drivers abound and one may wonder if the irrepressible surge of risk assets, a defining feature of H1, will continue unabated. For the foreseeable future, we expect economic growth in developed markets (DM) to remain above trend as the world gradually recovers from the exogenous Covid-19 shock. Consumption will stay healthy and corporate investments will increase in order to meet pent-up demand and ease supply-chain stress. In the US for example, households were still sitting on USD 2.5 trillion in excess savings in May. Not every cent will be spent, but this factor will definitely continue supporting growth. Meanwhile, DM monetary policy remains largely accommodative. Inflation is rising, mostly for temporary reasons such as base effects, supply-chain bottlenecks, etc., but central banks have also raised the upper limits of their inflation target range, diminishing the urgency of lift-off. For all these reasons, we remain constructive on risk assets.

We are well-aware that proliferation of new Covid-19 variants and uneven levels of vaccination around the world could spell trouble. There is always a risk that central banks raise rates too early or too aggressively —and here, the jury is still out on whether the increases in inflation have a “sticky” or structural element to them. Last but not least, valuations of some risk assets look rich.

At the same time, improving vaccination coverage will likely enable DM to manage the Delta outbreak; it might delay rather than halt the recovery. Also, Fed “smoke signals” suggest that tapering and actual lift-off are unlikely before 2022 and H2 2023, respectively. Meanwhile, there are still pockets of value in various market segments that the inquisitive investor can uncover.

Seasonal illiquidity as well as the Q2 earnings season (and corporate guidance in particular) will likely generate some volatility in the short term and while all the above factors balance out, the risk-reward trade-off may not be as generous as in the last 12 months. That’s why we believe that it is appropriate to take some chips off the table and keep the proceeds in liquid short-term instruments. At the onset of H2, we want to have the necessary ammunition to take advantage of bouts of weakness and target new opportunities, especially among dynamic asset classes.

In our overweight equity allocation, our preference goes to the Eurozone over the US on valuation grounds. One must still have solid exposure to the US, which will continue to benefit from the strong economic growth, Biden “bazooka” support programs (infrastructure, etc.) and healthy consumption. However, the Eurozone still has some catching up to do and therefore has more potential than the US, as vaccination lagged on our continent. Local consumers still have relatively high savings reserves, while the EU Recovery fund of EUR 750 billion will support growth beyond the initial recovery phase. Eurozone equity markets are also relatively cheaper and include more cyclical and value stocks. The UK is also cheap, but its market structure is less appealing, and we are a bit wary about the impact of Brexit. We are also less upbeat about emerging markets (EM) due to the fluid Covid situation there and the dependency of many EM countries on China, which recently had to loosen financial conditions (Reserve Requirement Ratios) to boost growth. We could turn more sanguine about Asian EMs if, as we expect, credit growth in China stabilizes by year-end. As to Japan, its leading indicators keep on disappointing, and the vaccination campaign is painfully slow there.

Source: Bloomberg, DPAM, 08.07.2021

Within equities, we are cautious about bond proxies such as utilities and staples, since they tend to underperform in a rising yield environment. We continue to favor quality growth stocks (high barriers to entry, niche markets, robust balance sheets, sterling governance, etc.) that benefit from structural tailwinds. Themes such as energy efficiency, aging demographics and automation still have our preference, as they have years of growth ahead of them. Earlier this year, we opted for a barbell strategy whereby core growth stocks were supplemented by value stocks, a tactical choice that paid off. In our view, the value rebound should have a second leg up in H2. Some healthcare stocks are turning into real value opportunities now, and select small-caps, cyclicals and lagging re-opening plays are also exhibiting value qualities.

For our fixed income allocation, we are underweight government bonds and cautious on duration due to the repricing of the economic upturn, the inflation conundrum and prospects of tightening down the road. They have a defensive role to play however, and we remain relatively positive on the European periphery. The convergence of periphery and core rates is still playing out, as the EU seems to finally get its act together as a “union”. Also, the sub-region will disproportionately benefit from the EU Recovery Fund. Overall, we actively look for opportunities that enhance yield, but do not increase interest rate risk. Investment grade credit can be a useful source of stable excess yield versus bunds, although valuations are not cheap by historical standards. High yield credit, especially short-term debt, is more alluring: defaults are not expected to rise significantly, and spreads are compelling in this low interest rate environment.

Finally, we’d like to highlight a few alternatives for diversification purposes and as some asset allocators might be interested in “proofing” their portfolios a bit against higher inflation. We have an overweight on real estate equities, as they will be able to cope with higher inflation through higher rents. Commodities linked to the recovery—copper for example and companies related to it—are another inflation hedge and diversifier: demand is outstripping supply not only because of the recovery but also due to years of underinvestment. Of note, copper will be a key ingredient in the development of the green economy: wind energy turbines, e-vehicles and recharging stations are highly copper intensive. In fixed income, we believe that US inflation-linked bonds have reached fair value, but European peers, notably from Italy, Spain and France, still offer good value.